Oct 21, 2024

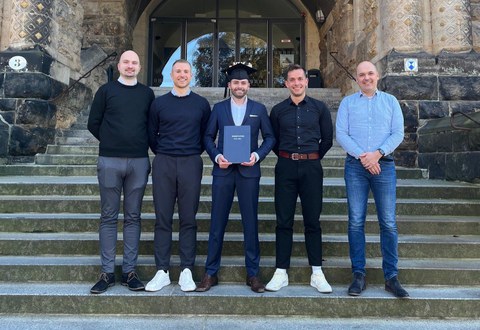

Successful Dissertation Defense by Stefan Albers

Stefan Albers successfully defended his dissertation on October 16, 2024. In the seven papers that comprise his cumulative dissertation, he explored the characteristics, information content, and interdependencies of implied volatility.

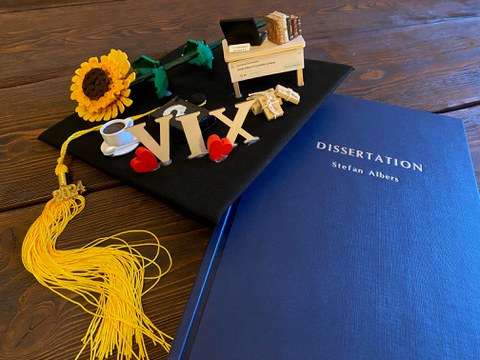

In these practice-oriented studies, Albers demonstrates, among other things, how the VIX1D, a short-term volatility index, is distorted by an "overnight bias" and should be modified for easier interpretation. By adjusting the VIX1D to account for the embedded risk premium, Albers developed a highly efficient and effective method for forecasting volatility in the U.S. stock market. Additionally, by analyzing spillover effects of the new Credit VIX indicators, he shows that the uncertainty perceived by market participants in corporate bonds, alongside stock market uncertainty, acts as a major transmitter of shocks, with a significantly higher impact than the uncertainty in commodity, currency, and interest rate markets.

His studies on volatility premiums and the characteristics of VIX futures provide valuable insights that can help optimize hedging and yield enhancement strategies. Thanks to these and other research results, Albers has already published papers in top-tier journals and is ranked among the top 3% of authors on SSRN.

Links to selected research papers:

The daily rise and fall of the VIX1D: Causes and solutions of its overnight bias