31.05.2024

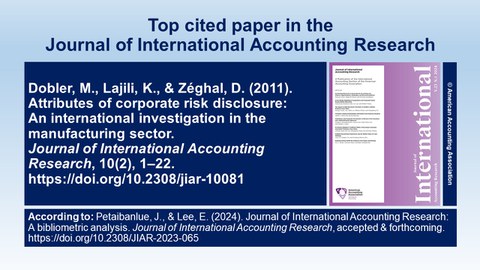

Artikel von Professor Dobler meistzitierter Beitrag im Journal of International Accounting Research

Laut der jüngst veröffentlichten bibliometrischen Analyse von Jirada Petaibanlue und Edward Lee ist der Artikel „Attributes of corporate risk disclosure: An international investigation in the manufacturing sector“ der meistzitierte Beitrag im Journal of International Accounting Research. Der Beitrag wurde von Michael Dobler (Technische Universität Dresden) sowie Kaouthar Lajili und Daniel Zéghal (beide Telfer School of Management, University of Ottawa) verfasst und untersucht Charakteristika und Determinanten der unternehmerischen Risikoberichterstattung in den USA, Kanada, dem Vereinigten Königreich und Deutschland. Die drei Autoren freuen sich sehr über den Impact ihrer empirischen Analyse.

Dobler, M., Lajili, K., & Zéghal, D. (2011). Attributes of corporate risk disclosure: An international investigation in the manufacturing sector. Journal of International Accounting Research, 10(2), 1–22. https://doi.org/10.2308/jiar-10081

Abstract:

This paper is the first multi-country investigation of comprehensive corporate risk disclosure. Based on a detailed content analysis of 160 annual reports, we analyze the attributes and the quantity of risk disclosure and its association with the level of firm risk in the U.S., Canadian, U.K., and German settings. We find a consistent pattern where risk disclosure is most prevalent in management reports, concentrates on financial risk categories, and comprises little quantitative and forward-looking disclosure across sample countries. In terms of risk disclosure quantity, U.S. firms generally dominate, followed by German firms. Cross-country variation in risk disclosure attributes can only partly be linked to domestic disclosure regulation, suggesting that risk disclosure incentives play an important role. While risk disclosure quantity appears to be positively associated with proxies of firm risk in North American settings, we find a negative association with leverage for Germany. This coincides with a “concealing motive” implied by an insider role of banks in the German financial setting.

Veröffentlichung auf Researchgate