May 31, 2024

Paper by Professor Dobler most cited paper in the Journal of International Accounting Research

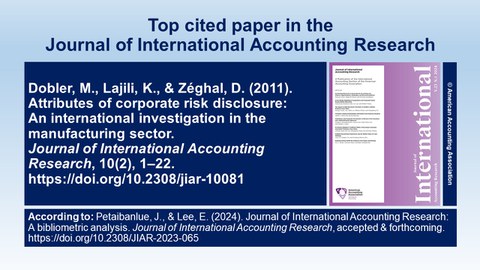

The recent bibliometric analysis by Jirada Petaibanlue and Edward Lee finds that the paper “Attributes of corporate risk disclosure: An international investigation in the manufacturing sector” is the most cited paper in the Journal of International Accounting Research. This paper is co-authored by Michael Dobler (TUD Dresden University of Technology), Kaouthar Lajili and Daniel Zéghal (both Telfer School of Management, University of Ottawa), and explores the characteristics and (the??) determinants of corporate risk reporting in the U.S., Canada, the U.K., and Germany. The authors are very pleased with the impact of their paper.

Dobler, M., Lajili, K., & Zéghal, D. (2011). Attributes of corporate risk disclosure: An international investigation in the manufacturing sector. Journal of International Accounting Research, 10(2), 1–22. https://doi.org/10.2308/jiar-10081

Abstract:

This paper is the first multi-country investigation of comprehensive corporate risk disclosure. Based on a detailed content analysis of 160 annual reports, we analyze the attributes and the quantity of risk disclosure and its association with the level of firm risk in the U.S., Canadian, U.K., and German settings. We find a consistent pattern where risk disclosure is most prevalent in management reports, concentrates on financial risk categories, and comprises little quantitative and forward-looking disclosure across sample countries. In terms of risk disclosure quantity, U.S. firms generally dominate, followed by German firms. Cross-country variation in risk disclosure attributes can only partly be linked to domestic disclosure regulation, suggesting that risk disclosure incentives play an important role. While risk disclosure quantity appears to be positively associated with proxies of firm risk in North American settings, we find a negative association with leverage for Germany. This coincides with a “concealing motive” implied by an insider role of banks in the German financial setting.

Visit the paper on Researchgate.