02.05.2024

Was treibt Stakeholder zur indirekten Teilnahme an der Entwicklung von IFRS? – Neue Publikation in TIJA

Die Entwicklung von International Financial Reporting Standards (IFRS) zur Finanzberichterstattung ist kein rein technischer, sondern ebenso ein politischer Prozess. An diesem können sich Stakeholder mithin durch die Abgabe von Stellungnahmen (comment letters) in Konsultationen zu Regulierungsprojekten beteiligen. In Europa besteht ein besonderes institutionelles Setting zur Teilnahme am Regulierungsprozess: Stakeholder können sich nicht nur direkt beim International Accounting Standards Board (IASB) beteiligen. Sie können – stattdessen oder zusätzlich – indirekt an den korrespondierenden Prozessen der European Financial Reporting Advisory Group (EFRAG) als Intermediär teilnehmen.

Martin Gäumann und Michael Dobler (Professur für BWL, insb. Wirtschaftsprüfung und Steuerlehre der Technischen Universität Dresden) nutzen dieses besondere institutionelle Setting in Europa in ihrem Beitrag in der renommierten Zeitschrift "The International Journal of Accounting" (TIJA), um innovative empirische Befunde zum indirekten Teilnahmeverhalten europäischer Stakeholder zutage zu fördern. Erstmals legen sie großzahlige und multivariate Befunde zu den Determinanten vor, mit denen eine (substitutive oder komplementäre) Teilnahme über einen Intermediär, namentlich die EFRAG, einhergehen. Die Befunde bergen wesentliche Implikationen, auch für die Rolle der EFRAG als europäischer Intermediär. Der Beitrag ist Open Access verfügbar.

Gäumann, M. & Dobler, M. (2024). Choice of participation method in setting International Accounting Standards: Evidence from EFRAG as an intermediary for indirect participation. The International Journal of Accounting, 59(1), 2450001. https://doi.org/10.1142/S109440602450001X

Synopsis

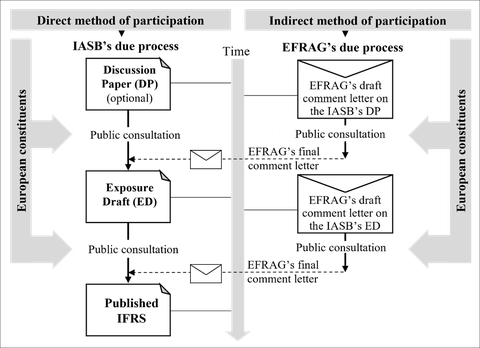

- The research problem: Prior empirical research on constituents’ participation in setting international accounting standards has focused on their decision whether or not to participate directly in the standard setter’s due process. However, because that focus neglects constituents’ choice between direct participation and indirect participation via an intermediary, we investigated the determinants of using an indirect method of participation as a substitute for, or in complement to, direct participation.

- Institutional setting: We exploited the European institutional setting, where the European Financial Reporting Advisory Group (EFRAG) serves as an intermediary for indirect participation in the due process of the International Accounting Standards Board (IASB).

- The test hypotheses: Based on rational choice theory, we hypothesized that constituents from EFRAG’s inner circle and from countries with smaller capital markets, lower English-language proficiency, and/or an accounting value profile more different from that embodied in International Financial Reporting Standards (IFRS) have a higher probability of choosing to use indirect participation.

- Adopted methodology: Using a sample of 7,766 comment letters (CLs) from 2005–2017, we focused on individual constituents and traced their use of indirect participation (i.e., sending CLs to EFRAG) versus direct participation (i.e., sending CLs to the IASB). We employed logistic regression models using the methods of participation as dependent variable to test our hypotheses. Controlling for factors used in prior research on direct participation, we estimated a primary model for the full sample of constituents and a secondary model with firm-specific variables for the subsample of constituents classified as corporate preparers.

- Findings and implications: We found strong evidence that the constituents’ membership in EFRAG’s inner circle is positively related, and capital market size in the constituents’ home countries is negatively related, to choosing to use indirect participation. Country-level English-language proficiency and differences in the accounting value profile in relation to IFRS also determine the choice of participation method. Our findings suggest that a preference for indirect participation relates to the barriers to using direct participation. We provide initial evidence of a neglected aspect of Sutton’s (1984) rational choice model and implications for EFRAG’s role as an intermediary.